Positioning Dort Financial Credit Union for the future while remaining firmly rooted in the present.

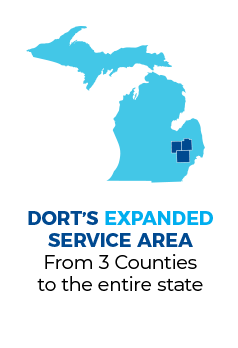

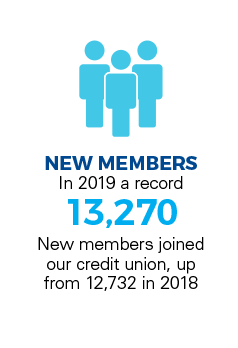

As we closed the door on 2019, we embarked on an important milestone for our credit union, as we expanded our charter from a federal to a state-chartered credit union. This conversion removes membership barriers and provides opportunity for future growth and sustainability as we are now able to serve anyone who lives, works, attends school, or worships in the state of Michigan. Today Dort Financial is poised for growth and expansion, as we remain intensely focused on our number-one priority of putting members’ financial needs first.

Activating expanded services to meet members growing demand.

Dort Financial Credit Union continued to invest in improved facilities/branches with expanded hours and services. Our call center hours have been expanded to 7:00 a.m. – 7:00 p.m. Monday through Friday, and 8:00 a.m. – 3:00 p.m. on Saturdays. Our loan products and E-lending options made it easier for our members to meet their home, auto and personal financial needs. We continue to develop and offer exciting new deposit products with opportunities for higher interest rates, including up to 5% annual percentage yield on our Boost Checking account!

Innovation in Action

Putting state-of-the-art technology into action for our members.

In 2019, we continued our efforts to offer new opportunities to members as we introduced new technology, remodeled branches and extended hours to provide members improved experiences. We now have some of the latest technology available in the financial services industry providing the option of booking a branch appointment online and having control of card management via our mobile app. Video Teller Machines (VTMs) have been introduced to provide more efficient transactions both in the drive-up lanes and in the lobby of several of our branches.